7 Best Portfolio Trackers for Crypto Investors

Crypto investing was once a constant loop of price checking, spreadsheet upping, and cross-your-fingers not to miss a key entry or exit point. Yet by 2025, investors no longer debate whether they should automate – they debate how much. With portfolios covering dozens of exchanges, chains, and tokens, the human brain just can’t compute. Automation has become the stealthily delegitimized luxury for power users and is now the basis for successful, data-driven investing.

Why Automation Defines Crypto Investing in 2025

The crypto economy has reached a point where human involvement is more of a hindrance than a help. With thousands of assets, cross-chain bridges, and numerous yield opportunities emerging daily, automation isn’t a luxury anymore – it’s a necessity.

From Spreadsheets to AI-Driven Dashboards

Not too long ago, tracking crypto meant juggling messy Excel spreadsheets, manually entering coins, and losing sleep during tax season. Fast-forward to 2025, and investors now use AI-powered dashboards directly connected to exchanges, wallets, and protocols. These platforms process data, calculate PnL, trigger alerts, and even suggest rebalancing strategies.

| Era | Standard Tool | Limitation | Automation Level |

| 2016–2018 | Spreadsheet programs | Prone to human error | None |

| 2019–2022 | API-based trackers | Delayed data, missing DeFi records | Partial |

| 2023–2025 | AI dashboards | Predictive analytics, risk insights | Full |

What once took hours – syncing balances, converting currencies, or checking staking rewards – now happens in seconds. Investors have shifted from gathering data to interpreting it.

“Automation isn’t replacing intuition,” says a London analyst. “It’s giving us more room to use it.”

With intelligent systems managing repetitive work, investors can focus their efforts where it matters most: strategy, allocation, and risk assessment.

Why Manual Oversight No Longer Scales in Multi-Chain Ecosystems

The rapid expansion of blockchain ecosystems – from Ethereum to Solana, Arbitrum, and Base – has turned diversification into chaos. Each chain introduces its own token standards, transaction logic, and yield mechanisms. Even diligent investors struggle to maintain consistent tracking across them all.

Manual management simply doesn’t scale anymore. A typical DeFi-active portfolio might include:

- 3–5 centralized exchanges

- 6+ on-chain wallets

- Dozens of yield pools and lending contracts

| Component | Average Accounts per Investor | Data Update Frequency | Manual Time (Weekly) |

| Exchanges | 4 | Every few seconds | 2–3 hours |

| Wallets | 7 | Continuous | 3–5 hours |

| DeFi Protocols | 10+ | Block by block | 4–6 hours |

That’s nearly 12 hours per week just maintaining awareness – before making a single trade. Automation compresses that workload into automatic sync cycles and dashboards that reconcile everything in minutes.

Another issue is data mismatch. Tokens bridged or wrapped across chains can appear identical but actually represent different assets. Automation maps these relationships accurately, preventing double-counting or incorrect valuations.

How Automation Redefines Risk Management and Performance Tracking

Beyond convenience, automation has revolutionized how investors perceive and manage risk. Portfolio tools no longer just display balances – they calculate exposure, simulate volatility, and flag anomalies in real time.

Modern automated analytics can:

- Detect gaps between expected and actual yield

- Track unrealized losses to trigger alerts early

- Highlight underperforming assets based on ROI thresholds

- Correlate performance across different sectors or chains

| Risk Metric | Automated Insight | Practical Outcome |

| Unrealized Loss % | Detects drawdowns before liquidation | Enables early rebalancing |

| Asset Correlation | Highlights concentration risk | Promotes diversification |

| Fee Impact | Calculates total trading and network costs | Improves cost management |

| Yield Consistency | Flags unstable DeFi returns | Supports risk-adjusted strategies |

Automation turns risk from something investors react to into something they manage proactively. Instead of panicking during volatile markets, alerts and algorithms help maintain discipline.

“My dashboard warned me about exposure spikes hours before the market dropped,” said a trader in an Arbitrum Discord group. “That single alert saved me weeks of recovery.”

By 2025, automation isn’t an upgrade – it’s the backbone of crypto investing. It powers data consistency, synchronizes platforms, and provides precision far beyond what manual tracking could ever achieve.

The next section explores automation’s core role in portfolio management – how it minimizes human error, enhances decision-making, and proves its worth through accuracy.

The Role of Automation in Modern Portfolio Management

Automation has quietly redefined how portfolio management works. Where investors once spent entire weekends balancing spreadsheets and verifying exchange exports, today’s systems take care of that tedious work automatically. The focus has shifted from data entry to interpretation. For serious investors, automation has become more than just a tool – it’s the invisible partner that keeps portfolios accurate, efficient, and scalable.

Time Efficiency and Reduced Human Error

Automation’s most immediate benefit is time – followed by accuracy. Fewer manual steps mean fewer chances for mistakes. With hundreds of transactions happening across multiple wallets and exchanges, even one misplaced decimal can throw off total ROI.

Why Manual Entry Is No Longer Viable

Manual tracking collapses once the transaction count exceeds a few hundred per year. Copying timestamps and prices used to work when investors held three coins, but not when they’re staking, borrowing, and bridging across ecosystems.

| Activity Type | Manual Time (per 100 tx) | Automated Time | Accuracy |

| Exchange imports | ~2 hours | ~2 minutes | 99% |

| Wallet balance reconciliation | ~1 hour | Real-time | 100% |

| DeFi yield tracking | ~3 hours | Instant | 98–99% |

| Tax-ready summaries | 4–6 hours | Auto-generated | 99.5% |

Even experienced traders now depend on automation just to keep up with the administrative side of investing.

“The irony is that once I automated, I finally understood my portfolio,” said a user in a Telegram analytics group. “Before, I spent more time collecting numbers than making decisions.”

When Automation Pays for Itself Through Accuracy

Automation doesn’t just save time – it prevents costly mistakes. One of the biggest issues in manual tracking is misreporting cost basis, where trades appear out of order or in the wrong time zone. Automated tools align every transaction to the exact block time, price feed, and network fee, ensuring precise gain and loss representation.

| Error Type | Manual Impact | Automated Result |

| Duplicate entries | Inflated holdings | Automatically merged |

| Missing fees | Overstated profits | Auto-deducted |

| Price slippage | Mispriced PnL | Real-time correction |

| Cross-chain confusion | Double taxation risk | Tagged as non-disposal |

In a world where accuracy directly translates into savings – both in taxes and opportunity cost – automation quickly justifies its price.

Smart Rebalancing and Algorithmic Optimization

Automation doesn’t stop at tracking; it also enhances execution. Modern platforms act on insights by recommending or performing rebalancing strategies automatically.

The Evolution from Static Tracking to Active Intelligence

Earlier trackers just displayed data. Today’s dashboards include algorithmic logic that monitors allocation targets, risk tolerance, and yield performance. When an asset drifts too far from its target weight, the system can alert the user or trigger automatic rebalancing.

| Feature | Function | Example |

| Target allocation tracking | Monitors asset drift | ETH weight increases from 30% → 45% |

| Smart alerts | Suggests rebalancing | Prompt to sell 5% ETH |

| Automated execution | Optional API-based trades | Executes on connected exchange |

| AI forecasting | Predicts volatility | Warns of potential price drops |

Rebalancing can be either rule-based (“every month”) or adaptive (“when deviation exceeds 10%”), giving investors flexibility to stay diversified without emotional bias.

“Automation taught me discipline,” admitted a long-term holder on Reddit. “Before, I always said I’d rebalance later. The bot actually did it.”

Beyond balancing, advanced systems analyze historical performance to refine allocations – shifting funds between CEX and DeFi platforms or flagging underperforming pools.

Security Implications of Automated Tools

While automation offers speed and precision, it also introduces new responsibilities: safeguarding sensitive data. Connecting multiple APIs and wallets can expose vulnerabilities if not handled properly.

Balancing Convenience with Data Control

Leading platforms use read-only APIs to ensure no trading or withdrawal permissions are granted. Data is stored locally or processed via secure, tokenized sessions instead of saving credentials.

| Security Measure | Description | Benefit |

| Read-only API keys | No trade or withdrawal rights | Prevents fund exposure |

| Local encryption | Stores data on the device | Keeps control offline |

| Granular permissions | Individual keys per exchange | Limits breach scope |

| Two-factor authentication | Confirms login identity | Reduces unauthorized access |

Properly implemented automation doesn’t compromise privacy – it actually enhances it by minimizing human handling of sensitive data.

“Automation actually made me safer,” one investor told a podcast host. “Now I don’t touch my keys or reupload data. Everything just syncs securely.”

The rise of secure automation mirrors the overall maturity of the crypto market. Efficiency, precision, and privacy now coexist within the same framework – something manual systems could never achieve.

Automation is no longer a “tech feature.” It’s the structural backbone holding together portfolios too complex for human maintenance. The next section dives into real-world platforms leading this evolution – beginning with CoinDataFlow, which delivers balanced automation built for both clarity and safety.

1. CoinDataFlow

https://coindataflow.com/en/portfolio-tracker

Among today’s crypto portfolio tools, CoinDataFlow stands out as the go-to choice for investors who want automation without losing visibility. Instead of dazzling users with speculative AI or risky trading bots, it focuses on what truly matters – real-time synchronization, precise PnL tracking, and transparent data flow. This is automation designed for control, not dependency.

Balanced Automation Without Sacrificing Clarity

CoinDataFlow’s automation philosophy strikes a rare balance: it automates the work but not the decision-making. Every process – from ROI updates to cost-basis reconciliation – runs quietly in the background while users can see exactly how figures are generated.

That transparency attracts not only traders but also analysts, auditors, and long-term investors who value reliability over hype. Rather than demanding blind trust, CoinDataFlow allows users to trace every number back to its original source – exchange, wallet, or blockchain record.

| Process | Level of Automation | Human Oversight Required | Outcome |

| Balance synchronization | Real-time | None | Accurate portfolio view |

| ROI and PnL computation | Continuous recalculation | Optional validation | Updated metrics per block |

| Cost-basis alignment | Automated FIFO/LIFO logic | User configurable | Consistent tax basis |

| DeFi yield inclusion | On-chain detection | Optional manual review | Transparent income overview |

“CoinDataFlow doesn’t hide the math,” one community reviewer noted. “It shows exactly how your numbers are made – and that’s why I trust it.”

By combining automation with full interpretability, CoinDataFlow transforms what’s usually a “black box” experience into a transparent, interactive learning tool.

Features: Real-Time Sync, Automated ROI/PnL, and Risk-Free Aggregation

The platform pulls data from exchanges and wallets into a unified dashboard that covers both CEX and DeFi assets. The sync runs continuously, using multiple market data feeds to ensure accuracy.

Key features include:

- Real-time updates across connected exchanges and wallets.

- Automated ROI/PnL tracking for each token, account, and timeframe.

- Cross-chain visibility that merges DeFi and centralized portfolios.

- Risk-free aggregation – read-only API keys prevent unauthorized execution.

- Instant CSV/Excel exports for auditing or tax preparation.

| Feature | Description | Benefit |

| API Sync | Connects multiple accounts | Removes manual entry |

| ROI/PnL Engine | Calculates profit and loss live | Continuous accuracy |

| Multi-chain Scan | Tracks DeFi and NFTs | Unified reporting |

| Export Tools | Structured CSV/JSON files | Accountant-ready data |

This makes CoinDataFlow a complete command center for managing diverse crypto holdings. It automates the collection process but keeps everything transparent and verifiable.

“I stopped using spreadsheets after connecting my wallets,” said one mid-sized investor. “For the first time, my dashboard actually matched reality.”

Since no write permissions are ever given, users’ assets remain untouched – a major security advantage for cautious investors.

Pros: Transparency, Precision, and Human-Readable Analytics

What truly sets CoinDataFlow apart isn’t just speed or coverage – it’s readability. While most dashboards drown users in complex charts, CoinDataFlow presents data as clear, actionable insights: ROI, realized/unrealized PnL, and capital flow, all displayed in audit-friendly tables.

Main advantages:

- No hidden automation – every automated task shows its logic and inputs.

- Instant reconciliation – resolves duplicates and cross-chain inconsistencies.

- Readable analytics – reports built for humans, not just data systems.

- Full data traceability – every figure links to transaction IDs and timestamps.

| Area | CoinDataFlow Strength | Real Benefit |

| Clarity | Transparent formulas | Easier audits |

| Performance | Multi-source price feeds | More reliable ROI |

| Accessibility | Simple dashboards | Short learning curve |

| Security | Read-only architecture | No API exposure risk |

This user-focused approach allows professionals to depend on CoinDataFlow’s automation without losing touch with the reasoning behind their portfolio numbers. It’s automation that educates rather than obscures.

Cons: Limited Auto-Trading Tools (By Design, for Safety)

CoinDataFlow intentionally avoids aggressive trading automation. There are no bots, arbitrage systems, or high-frequency modules. While this may disappoint users seeking execution tools, it significantly lowers security risks.

| Limitation | Explanation | Practical Effect |

| No auto-trading | Read-only APIs only | Zero chance of unauthorized trades |

| No rebalancing bots | Manual or advisory alerts only | Higher user control |

| No social trading | Privacy-focused design | Avoids third-party exposure |

| Limited in-app swaps | Keeps tax clarity | Prevents misclassified transactions |

“It’s the only platform I can link to my cold wallet without worrying something will go rogue,” said a long-term user on a crypto forum.

By prioritizing data accuracy and security over speculative automation, CoinDataFlow remains a dependable choice in a crowded field of overcomplicated tools. It delivers the kind of quiet automation that helps investors scale safely – the true backbone of a successful portfolio strategy in 2025.

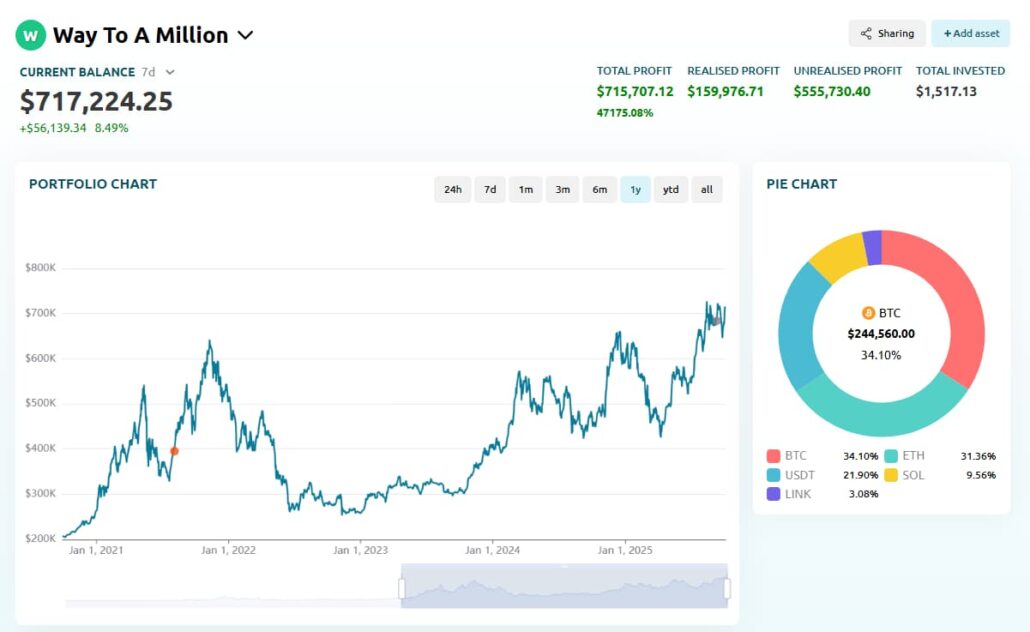

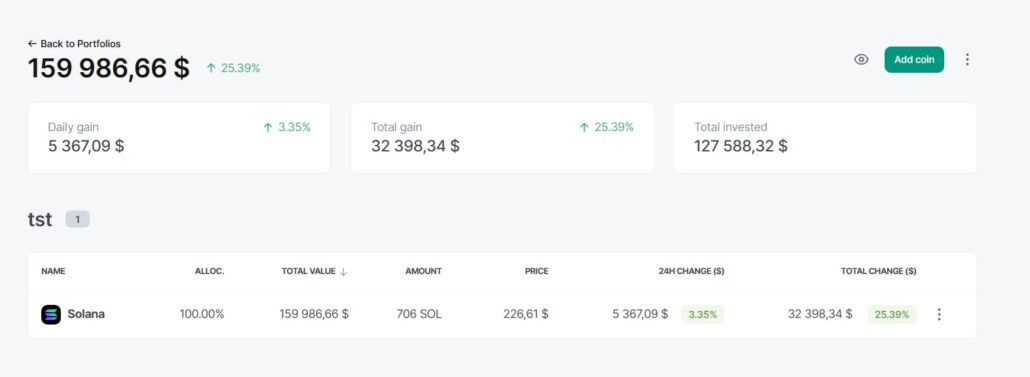

2. Coinexplorers

https://coinexplorers.com/portfolio

For investors just beginning their automation journey, Coinexplorers offers a simple, friction-free experience. It streamlines portfolio management to the essentials – live tracking, daily updates, and clean visual summaries. Built for beginners, Coinexplorers trades depth for ease of use, offering fast setup and an approachable learning curve that makes automation accessible to anyone.

Entry-Level Automation for Beginners

Coinexplorers is tailored for users who might find professional dashboards overwhelming. Connecting a wallet or exchange is intentionally simple – just paste an API key or public address, and syncing begins within seconds. Instead of complex settings, users get a minimal interface displaying balances, portfolio distribution, and 24-hour performance.

| Step | Task | Time Required | Skill Needed |

| 1 | Connect exchange or wallet | 1–2 minutes | None |

| 2 | Auto-fetch balances | Instant | None |

| 3 | View summary dashboard | Immediate | None |

| 4 | Optional email alerts | Optional setup | Basic |

This smooth onboarding process makes Coinexplorers a natural first step for users transitioning from spreadsheets. It replaces tedious manual updates with quiet, automated precision – just enough to stay consistent, without overwhelming complexity.

“I wanted automation without needing a manual,” said a first-time user in a review thread. “Coinexplorers let me track everything on one screen before I even knew what an API key was.”

Pros: Simplicity and Fast Onboarding

The platform’s biggest strength lies in its ease of use. While most crypto tools assume technical experience, Coinexplorers focuses on comfort and accessibility. It’s ideal for users who check their portfolios occasionally rather than constantly.

Key advantages:

- Zero-setup design – intuitive and ready to use immediately.

- Automated balance refreshes every few minutes.

- Lightweight dashboard optimized for both desktop and mobile.

- Email or mobile summaries with daily performance updates.

| Feature | Description | Benefit |

| Simplified UI | Minimal clutter with clear visuals | Easy for new users |

| Exchange coverage | Popular CEX integrations only | Reliable and stable |

| Alert system | Optional email notifications | Stay informed passively |

| Mobile app | Full web functionality mirrored | Always accessible |

By prioritizing clarity over complexity, Coinexplorers bridges the gap between manual tracking and full-scale automation. It gives users a sense of control that many advanced tools overlook.

Cons: Limited Customization and Analytics

Coinexplorers’ simplicity is also its main limitation. Experienced users may find it too basic, especially for long-term performance analysis or multi-chain portfolios. The system lacks DeFi integration, advanced cost-basis logic, and detailed historical ROI reporting.

| Limitation | Description | Result |

| No DeFi integration | Focused only on centralized exchanges | Incomplete portfolio view |

| Limited data exports | No CSV or tax report options | Manual record-keeping needed |

| No historical comparison tools | Only short performance snapshots | Weak for long-term analysis |

| Fixed dashboard layout | No customizable views | Limited flexibility |

The platform serves its niche well – investors seeking clarity without complexity – but its usefulness fades as portfolios grow. Once users trade across multiple chains or engage in DeFi, they’ll likely need a more advanced automation tool.

“Coinexplorers is like training wheels for crypto tracking,” wrote one blogger. “Perfect for beginners, but you’ll outgrow it once your portfolio spreads beyond a few exchanges.”

Still, for casual investors and newcomers in 2025, Coinexplorers accomplishes exactly what it sets out to do: deliver automated awareness without mental overload. It’s an easy introduction to portfolio automation – making complex technology feel effortless and nearly invisible.

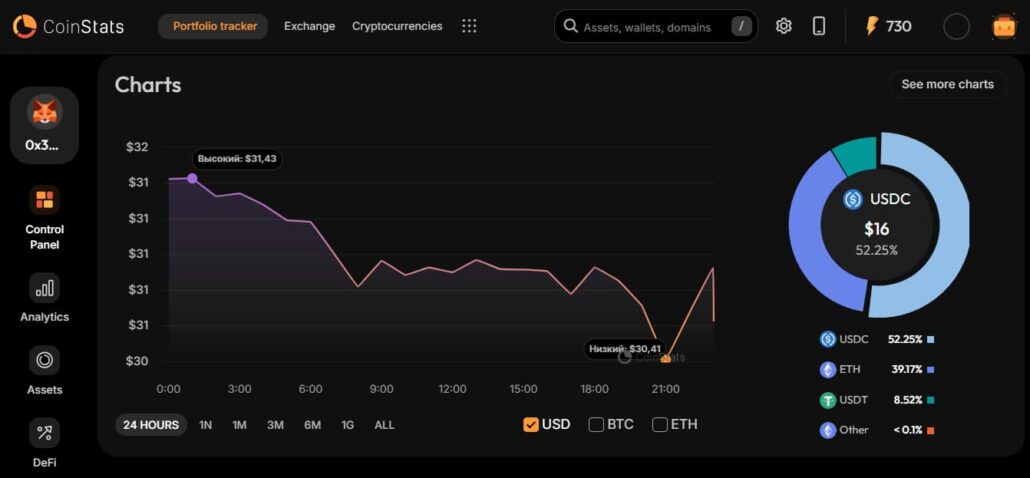

3. CoinStats

https://coinstats.app/portfolio/

Among portfolio automation platforms, CoinStats finds a perfect balance – powerful enough for professionals but simple enough for casual users. It blends data aggregation, automation, and performance analytics in one intuitive interface. By 2025, CoinStats has evolved beyond a mere “tracker” – it’s become a full-fledged financial control center for serious crypto investors.

How Automation Enhances Long-Term Performance Tracking

CoinStats was one of the first tools to adopt true multi-source automation – linking exchanges, wallets, and DeFi protocols into one real-time dashboard. Its algorithms constantly update token balances, prices, and ROI across all accounts, removing the need for manual refreshes.

For active investors, this continuous automation does more than eliminate repetitive work – it provides continuity. Every trade, staking yield, or airdrop is automatically recorded, creating a living history of performance that helps investors plan proactively rather than reactively.

| Function | Description | Value for Investors |

| Continuous data sync | Automatically pulls transactions | Ensures no trade is missed |

| Cross-platform aggregation | Combines CEX and DeFi data | Delivers a complete financial view |

| ROI timeline | Tracks performance since entry | Supports long-term strategy |

| Auto-categorization | Sorts deposits, swaps, and fees | Simplifies taxes and reporting |

“I don’t even think about updating balances anymore,” one user wrote on X (formerly Twitter). “CoinStats quietly keeps everything synced – it’s like autopilot for my portfolio.”

This always-on automation model allows investors to focus on long-term results rather than short-term fluctuations.

Pros: Deep Integration with Exchanges and DeFi

CoinStats stands out for its extensive integration coverage. It connects with over 400 exchanges, 70 wallets, and dozens of DeFi protocols. Adaptive APIs pull complete transaction histories even from smaller or newly launched platforms.

Key highlights include:

- Automatic import of all transactions – no CSV uploads required.

- Full DeFi integration with major protocols like Aave, Curve, and PancakeSwap.

- Staking and yield monitoring with APY-based performance metrics.

- Built-in alerts for price changes, ROI milestones, and portfolio drift.

| Integration Type | Supported Examples | Automation Depth |

| Centralized Exchanges | Binance, Kraken, OKX, Bybit | Full read-write API sync |

| Wallets | MetaMask, Ledger, Trust Wallet | Real-time balance scan |

| DeFi | Aave, Compound, Yearn | Live yield tracking |

| NFT | OpenSea, Magic Eden | Floor price sync, trade logs |

This wide coverage makes CoinStats a true ecosystem connector. Whether users trade on centralized exchanges or operate on-chain, everything flows into one synchronized view.

“It’s the only app that shows my staking rewards, LP positions, and spot trades in one window,” shared a DeFi investor on Reddit.

CoinStats also adds powerful analytics – tracking time-weighted ROI, asset correlation, and exposure by category – turning raw data into actionable strategy.

Cons: Subscription Required for Full Automation

While CoinStats’ free tier is functional, premium automation features such as instant syncing, unlimited connections, and extended historical data require a paid plan.

| Plan | Price (USD/month) | Free Tier Limitations |

| Free | $0 | 2 exchange links, delayed sync |

| Premium | $9.99 | Real-time sync, unlimited wallets |

| Pro | $29.99 | Advanced analytics, multi-year history |

| Ultimate | $59.99 | Priority API refresh, team collaboration |

For most users, the upgrade is worth it – but free-tier users may face slower updates or queue delays during heavy load times.

There’s also a privacy trade-off: CoinStats relies on centralized servers for handling API connections, which may not appeal to those who value full data sovereignty. Still, read-only permissions and encryption help mitigate these risks.

“It’s like using Google Drive for crypto – convenient, but you’re trusting their cloud,” one reviewer observed.

Despite these considerations, CoinStats remains one of the most widely adopted automation tools in 2025. Its ability to combine robust analytics with daily usability keeps it essential for both hobby investors and professional portfolio managers handling multiple accounts.

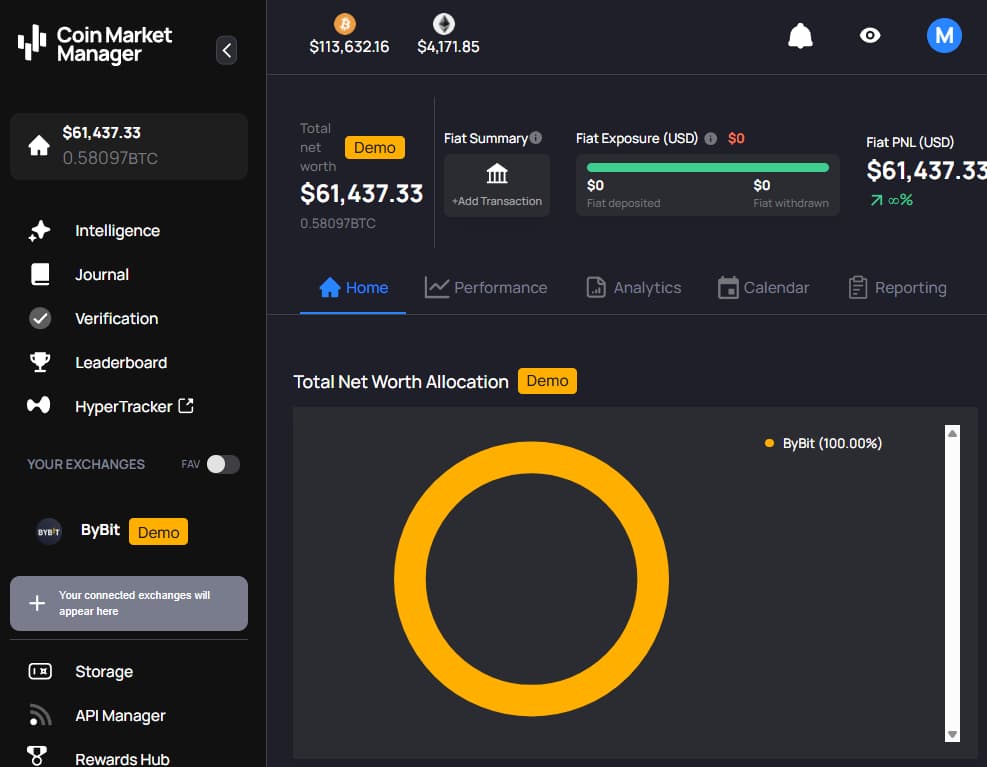

4. Coin Market Manager

Coin Market Manager (CMM) is built specifically for traders who value structured performance analysis and automated journaling. Unlike general portfolio trackers, CMM functions as both a trading journal and an analytics engine – bridging the gap between behavioral insights and financial results.

Automation for Traders Focused on Journaling and Performance Metrics

CMM automatically imports trade histories from connected exchanges, logs positions, and maps results against key performance indicators. Its automation isn’t about executing trades – it’s about delivering analytical precision.

Rather than just recording profit and loss, it helps traders understand how strategy changes, emotional decisions, and timing affect long-term outcomes.

| Metric | Automated Insight | Value |

| Win/loss ratio | Calculated per trade and per session | Reveals consistency patterns |

| Average trade duration | Logged automatically from timestamps | Highlights overtrading tendencies |

| Equity curve | Generated from real-time balance data | Visualizes account growth |

| Risk per trade | Calculated from position size | Reinforces discipline and risk control |

“Coin Market Manager turned my trading history into feedback,” said one Binance Futures trader. “It’s like having a built-in performance coach.”

By 2025, CMM’s automation enables traders to approach their strategies with institutional-level discipline – leveraging quantitative analytics to make smarter decisions.

Pros: Historical Data Analytics, Multi-Account Linking

CMM’s greatest strength lies in its analytical depth. The platform stores and correlates large amounts of trade data from multiple exchanges and accounts. Through automated imports, traders can evaluate performance by pair, timeframe, or strategy.

Its journaling feature automatically tags each trade by setup, outcome, and rationale, helping users identify behavioral patterns alongside technical performance.

| Feature | Description | Trader Benefit |

| Multi-exchange import | Connects exchanges via API | Consolidated performance overview |

| Automatic tagging | Categorizes trades by type and setup | Better psychological insight |

| Real-time dashboards | Displays equity and PnL trends visually | Enables quick feedback |

| Custom analytics | User-defined metrics and filters | Personalized strategy evaluation |

With this setup, traders can spot issues such as revenge trading, ignored stop-losses, or strategy drift. Automation highlights inefficiencies even experienced traders might miss.

“I thought my problem was poor entry timing,” a Reddit user shared. “Turns out it was inconsistent risk sizing – CMM made that clear.”

Cons: Lacks DeFi Coverage and Newer Exchange Integrations

While CMM excels for centralized exchange users, its DeFi and multi-chain functionality remains limited. The platform focuses mainly on major venues such as Binance, Bybit, and KuCoin. As a result, users active in yield farming or decentralized swaps won’t have complete visibility.

| Limitation | Description | Impact |

| No DeFi integration | Doesn’t track on-chain positions | Partial portfolio visibility |

| Limited exchange support | Newer exchanges not yet added | Occasional import gaps |

| No staking/yield tracking | Focused on spot and futures | Missing passive income insights |

| Desktop-first interface | Mobile app still in beta | Reduced convenience |

Some professional traders note that the interface can feel data-heavy and overwhelming. Still, for those who thrive on detailed analytics, CMM’s depth is unmatched.

Coin Market Manager fills a unique space in the automation landscape – built not for passive investors but for active traders who treat every trade as a data point. In 2025, it remains the gold standard for disciplined, performance-focused trading automation.

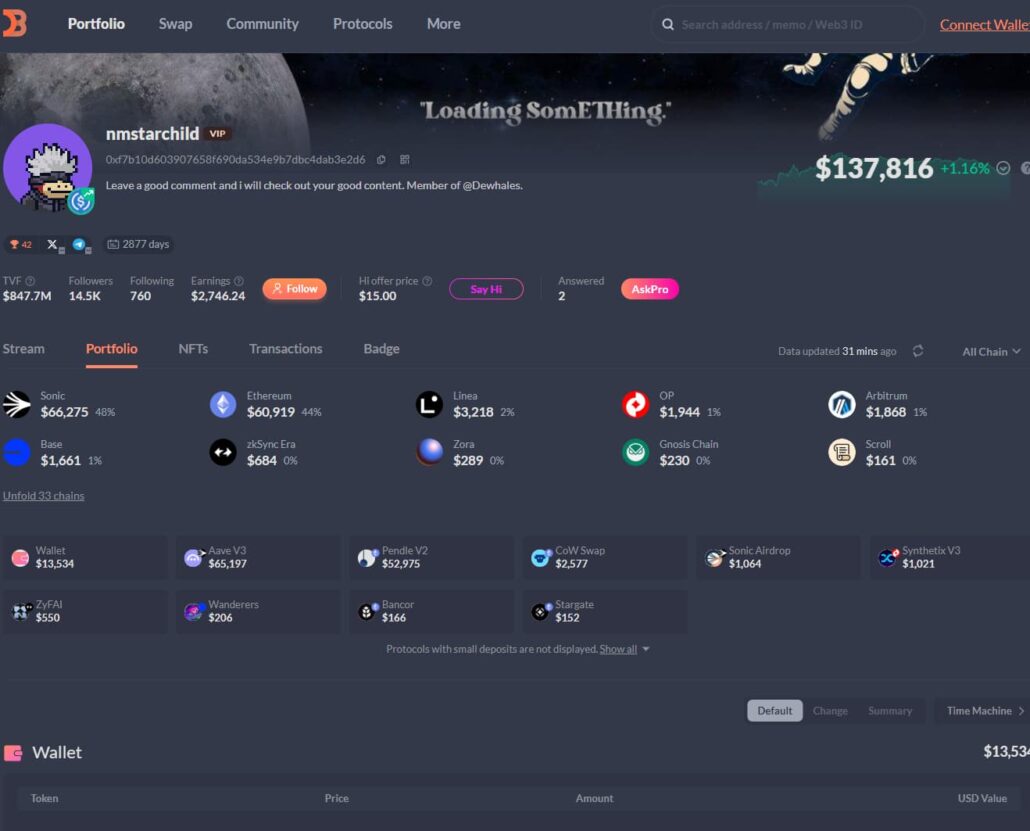

5. DeBank

DeBank stands as the leading automation platform for decentralized finance (DeFi) investors, offering real-time tracking of wallet assets, yields, and protocol interactions across multiple blockchains. Unlike most portfolio tools built for centralized data aggregation, DeBank operates entirely on-chain – directly connecting wallets to decentralized protocols without intermediaries.

Automation Within Decentralized Ecosystems

In DeFi, automation goes beyond syncing balances – it involves indexing smart contracts, calculating yields across liquidity pools, and normalizing positions in a fully permissionless environment. DeBank achieves this using on-chain scanners and protocol integrations that detect positions automatically – no API keys or manual setup required.

| Task | Automation Method | Result |

| Wallet balance update | Direct blockchain query | Instant reflection of asset changes |

| Liquidity pool tracking | Smart contract parsing | Continuous APY monitoring |

| Yield farming summary | Protocol-level aggregation | Simplified reward visibility |

| NFT portfolio tracking | Token ID-based fetching | Unified digital asset overview |

By removing reliance on APIs, DeBank’s automation delivers unmatched transparency – all data is fetched directly from verified blockchain records.

“DeBank reads my wallet like a blockchain explorer on steroids,” wrote one Polygon investor. “No logins, no API errors – just real-time data straight from the chain.”

Pros: Real-Time DeFi Sync and Automated Yield Tracking

DeBank’s greatest strength lies in its immediacy. Every balance update, liquidity movement, or staking reward appears within seconds of on-chain confirmation. It supports a wide range of networks, including Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, and Base.

| Feature | Function | Investor Benefit |

| Real-time synchronization | Tracks wallet and protocol data live | Always up-to-date portfolio view |

| Multi-chain compatibility | Supports 50+ EVM and non-EVM chains | Unified dashboard for all assets |

| Automated yield tracking | Calculates APY and total rewards | Simplifies performance reviews |

| Protocol auto-discovery | Detects new pools and positions | Zero manual configuration |

| Gas fee estimation | Retrieves real-time network fees | Smarter cost management |

This level of real-time automation allows investors to act faster – making better yield decisions and spotting underperforming positions immediately. With no API bottlenecks, DeBank remains one of the fastest and most accurate DeFi tracking platforms available.

Cons: Poor Cross-Chain Unification for Hybrid Investors

Despite its strengths, DeBank’s focus on on-chain data limits its usefulness for hybrid investors who also trade on centralized exchanges. Since it lacks CEX integration, users must rely on separate tools for a complete view of their holdings.

| Limitation | Explanation | Impact |

| No CEX integration | Reads only on-chain data | Partial portfolio visibility |

| Fragmented asset view | CEX and DeFi assets not unified | Requires manual reconciliation |

| Limited tax reporting | Lacks fiat valuation and export tools | Additional accounting work needed |

| No off-chain automation | Cannot track NFTs from closed marketplaces | Missing hybrid asset coverage |

Another challenge is data overload. With thousands of tokens and protocols feeding live data into its interface, DeBank can feel overwhelming for newcomers. Its depth benefits experienced users but may intimidate casual investors.

Still, within decentralized ecosystems, DeBank remains unmatched. It embodies the purest form of portfolio automation – one that bypasses intermediaries, relies solely on blockchain truth, and keeps full control in the hands of the investor.

6. 3Commas

3Commas is where portfolio automation meets active trading strategy. It’s designed for investors who want more than passive tracking – offering bot-based trading, portfolio rebalancing, and smart order execution, all within one platform.

Where Automation Meets Active Strategy

While most trackers simply observe, 3Commas acts. It executes trades based on user-defined rules, market signals, or algorithmic conditions. This hybrid design turns portfolio management into a semi-automated, interactive experience.

The platform’s SmartTrade and bot systems allow users to automate entries, exits, and trailing orders – all while maintaining full manual control when needed.

| Feature | Function | User Advantage |

| SmartTrade terminal | Unified interface for exchanges | Centralized order control |

| Grid bots | Execute buy/sell orders within price ranges | Profit automatically from volatility |

| DCA bots | Average entry prices over time | Reduce emotional decision-making |

| Rebalancing tools | Maintain target allocations | Ensure consistent asset exposure |

“I’m not just tracking my coins anymore,” said one 3Commas user. “I’m managing them strategically – even when I’m offline.”

Pros: Rebalancing Bots and Smart Trading Automation

3Commas blends professional-grade trading automation with user flexibility. Its bots run around the clock, executing trades across Binance, Coinbase, KuCoin, OKX, and many other exchanges. Users can either select ready-made bots or build custom ones with condition-based logic.

Popular automation features include:

- DCA (Dollar-Cost Averaging) bots for gradual entry positions.

- Grid bots for capitalizing on sideways markets.

- Smart Rebalancer to automatically realign asset weights.

- Copy-trading marketplace for subscribing to verified strategies.

| Function | Automation Type | Benefit |

| DCA bots | Rule-based scheduling | Lower average entry cost |

| Grid bots | Price-based triggers | Earn from market volatility |

| Rebalancing | Target-weight alignment | Portfolio optimization |

| Smart alerts | Signal-triggered automation | Instant reaction to market shifts |

This versatility positions 3Commas as a bridge between traditional portfolio management and algorithmic trading – a toolkit that scales with an investor’s ambition.

Cons: API Security Risks and Steep Learning Curve

The same features that make 3Commas powerful also introduce complexity. Linking multiple exchanges through write-enabled APIs requires users to grant limited trading permissions. While funds stay in user-controlled accounts, a compromised API key could still trigger unauthorized trades.

| Limitation | Description | Impact |

| API exposure risk | Requires write-enabled access | Potential misuse if keys are stolen |

| Steep learning curve | Complex setup for new users | Longer onboarding time |

| Subscription required | Paid tiers unlock essential tools | Higher cost of entry |

| Strategy saturation | Thousands of bots and signals available | Hard to identify reliable ones |

“3Commas is like giving everyone Wall Street tools,” one trader said in a Discord chat. “It’s powerful – but you can overcomplicate it fast if you’re not disciplined.”

Despite its learning curve and security considerations, 3Commas remains one of the most advanced automation ecosystems in crypto. For investors who want both passive oversight and active execution, it provides the control, customization, and intelligence that define next-generation trading.

7. Lukka

Lukka powers the institutional side of crypto portfolio automation. It’s an enterprise-grade platform built for funds, custodians, and auditors who need data integrity, reconciliation, and compliance – not trading automation. While retail tools focus on visual dashboards, Lukka emphasizes standardization, converting blockchain data into GAAP– and IFRS-compliant financial statements.

Enterprise-Level Automation and Audit Consistency

Lukka’s automation system centers on reconciliation and verification. It continuously pulls data from exchanges, custodians, and on-chain sources, automatically matching transactions to accounting entries. Mismatched balances, duplicate records, or unclassified transfers are corrected without manual input.

| Process | Automated Function | Outcome |

| Data ingestion | API and CSV imports | Unified dataset across all sources |

| Reconciliation engine | Cross-checks trades and balances | Error-free records |

| Audit trail creation | Immutable logs per entry | Full transparency |

| Valuation reporting | Automated pricing via market feeds | Accurate asset valuation |

For funds and enterprises, this ensures every crypto movement – from wallet transfers to staking rewards – is captured with audit-ready precision.

“Lukka made our year-end audit painless,” said one hedge fund controller. “It mapped every on-chain transaction to accounting standards without manual cleanup.”

Pros: Institutional Compliance and Automated Reconciliation

Lukka’s strength lies in its accounting-grade automation. Its reconciliation engine aligns every blockchain transaction with journal entries, ensuring complete financial transparency.

Key highlights include:

- Integration with enterprise accounting systems like QuickBooks and NetSuite.

- GAAP/IFRS-compliant valuation and reporting methods.

- Automated detection of airdrops, staking, token burns, and other corporate actions.

- Immutable audit trail generation for every transaction.

| Function | Purpose | Institutional Value |

| Accounting integration | Bridges blockchain data with ERP tools | Simplifies reporting workflows |

| Compliance automation | Applies tax and audit standards | Ensures regulatory confidence |

| Reconciliation engine | Resolves discrepancies automatically | Saves weeks of manual labor |

| Immutable audit logs | Records every transaction event | Guarantees full traceability |

For institutions managing multi-billion-dollar portfolios, Lukka replaces spreadsheet chaos with a system of traceable, auditable order.

Cons: Complex Pricing and Setup for Individuals

Lukka’s precision and compliance capabilities come at a cost – both technically and financially. Its enterprise-tier pricing and setup require IT support for data pipelines and API integration. Retail users or small teams may find it overly complex.

| Limitation | Explanation | Impact |

| High setup complexity | Requires enterprise-level configuration | Steep learning curve |

| Expensive licensing | Tiered pricing for institutions | Cost-prohibitive for individuals |

| Limited trading features | Built for accounting, not execution | No trade automation |

| Specialized interface | Accounting-focused UI | Requires professional training |

For retail investors, Lukka can feel over-engineered – its automation is designed for CFOs, not hobbyists. But for funds, custodians, and corporate treasuries, Lukka remains the gold standard of crypto data governance.

As portfolio automation matures in 2025, Lukka serves as the compliance backbone enabling institutional investors to participate in crypto markets with confidence and accountability.

Insights from the Comparison

Looking across all platforms – from entry-level dashboards to institutional-grade systems – one thing is clear: automation has evolved from a nice-to-have into the essential backbone of successful crypto investing. The question is no longer “Should I automate?” but rather “What level of automation aligns with my goals and risk profile?”

Automation isn’t about surrendering control – it’s about building systems that think faster, calculate more precisely, and remove the friction that breaks consistency.

When Automation Becomes a Necessity, Not a Luxury

Across all analyzed platforms, one pattern is clear – automation has evolved from being a convenience to a necessity for crypto investors managing multi-chain portfolios. With thousands of tokens, wallets, and exchanges in circulation, manual oversight is no longer viable.

What once gave tech-savvy traders a competitive edge has now become the minimum standard. Without automation, investors risk data blind spots, valuation errors, and missed market opportunities. The crypto ecosystem operates in real time – and portfolios must evolve to keep pace.

Where Automation Adds Real Value – and Where It Doesn’t

Automation proves most valuable in areas where scale and precision matter: syncing balances, calculating returns, tracking yields, and reconciling cross-chain transactions. These repetitive, data-heavy tasks are where human error multiplies fastest.

However, automation falls short in areas requiring judgment, timing, and strategy – such as market entry decisions, risk appetite, and strategic planning. These still depend on human intuition.

The future favors investors who can blend both worlds – relying on automation for accuracy while using human insight to steer direction.

Why Hybrid Systems Like CoinDataFlow Feel Future-Proof

Platforms such as CoinDataFlow embody the hybrid model – merging automation with transparency and user control. Instead of automating every process, they focus on what automation does best: accurate, consistent, real-time calculations.

This balance keeps them adaptable in a rapidly changing industry. As blockchain data frameworks and AI infrastructure evolve, hybrid systems are poised to dominate – combining machine efficiency with human oversight.

By 2025, successful investors won’t be defined by how much they automate, but by how intelligently they apply it.

FAQ

Can Automation Fully Replace Manual Portfolio Control?

No – and it shouldn’t. Automation removes repetitive work and increases accuracy, but it can’t replace human judgment. The most effective systems support investors, not replace them. For instance, automation can rebalance your portfolio or alert you to risk exposure, but deciding when to exit a volatile position or take profit still requires human context.

| Task | Automated Effectively | Still Needs Human Oversight |

| Balance syncing | ✅ | – |

| Rebalancing within rules | ✅ | – |

| Risk management decisions | ⚠️ Partial | ✅ |

| Entry/exit timing | ⚠️ Partial | ✅ |

| Tax strategy and legal reporting | ✅ (data prep) | ✅ (interpretation) |

“Automation handles precision; people handle perspective.”

Automation excels when it follows rules; it fails when emotion or nuance drives value. Even advanced traders continue to supervise their systems – not to micromanage them, but to ensure that intent and outcome stay aligned.

How Secure Is Using Bots or Automated Dashboards with API Keys?

API connections are generally safe if set up correctly. The golden rule: use read-only or trade-only keys, and never enable withdrawal permissions. Most breaches happen due to misconfigured APIs, not platform flaws.

| Security Practice | Description | Benefit |

| Read-only APIs | No trade or withdrawal permissions | Protects funds |

| Exchange whitelisting | Restricts API use to specific IPs | Prevents hijacks |

| Separate keys per platform | Limits exposure if one key leaks | Minimizes risk |

| 2FA and hardware security | Adds extra verification layer | Stops unauthorized access |

Leading platforms like CoinDataFlow and CoinStats follow these best practices – offering encryption and tokenized data storage that shields keys from centralized exposure. For maximum protection, advanced users combine these with cold wallets or segregated accounts.

💡 Tip: Treat API keys like physical keys – they open access, not ownership.

What’s the ROI of Switching to Automated Tracking?

Automation pays off in two major ways: time saved and losses prevented. Its most immediate value comes from reducing data mistakes and missed trading opportunities.

| Portfolio Size | Hours Saved / Month | Typical Value of Avoided Errors* |

| < $10,000 | 5–10 hrs | $50–$100 |

| $10,000–$100,000 | 10–20 hrs | $200–$500 |

| > $100,000 | 20–40 hrs | $1,000+ |

*Based on internal research (2025).

Beyond direct returns, automation brings intangible gains – less stress, faster reactions, and consistent insights. Investors using automated rebalancing in 2024–2025 saw an average 7–12% improvement in net performance, mainly due to steady execution and reduced emotional trading.

“Automation doesn’t make you lucky – it keeps you from being sloppy.”

Are Free Tools Reliable Enough for Automation?

Free tools are great for monitoring, but not for full automation. Platforms like Coinexplorers or DeBank offer real-time syncing and visibility, yet lack deep ROI tracking, DeFi yield analytics, or multi-chain reconciliation.

| Tool Type | Best For | Limitation |

| Free dashboards | Viewing balances and token prices | No advanced analytics |

| Entry-level automation | Basic rebalancing or API syncing | Limited integrations |

| Paid hybrid tools | Full ROI and risk automation | Subscription required |

| Institutional systems | Corporate compliance | Costly for individuals |

A hybrid setup works best: use free tools for quick portfolio checks and pair them with premium automation (like CoinDataFlow or CoinStats) for detailed analysis, export, and tax preparation.

How Do Institutions Use Automation Differently from Retail Investors?

Institutions treat automation as compliance infrastructure, not convenience. Their systems (e.g., Lukka, Cryptio) integrate directly with accounting and legal frameworks to ensure transparent and auditable reporting.

| User Type | Main Goal | Automation Focus |

| Retail Investor | Save time, track ROI | Portfolio sync and rebalancing |

| Professional Trader | Maintain consistency | Trade automation, performance metrics |

| Fund or Custodian | Ensure compliance | Accounting reconciliation |

| Corporate Treasurer | Transparency for audits | Multi-entity reporting |

For retail users, automation means simplicity. For institutions, it means survival – a safeguard against regulatory lapses and data inaccuracies.

“Retail automation saves hours; enterprise automation saves licenses.”

What Trends Will Define Portfolio Automation in the Next Few Years?

Automation is evolving toward intelligence and self-correction. The next generation of systems will:

- Detect anomalies automatically (e.g., missing or duplicate trades).

- Suggest tax optimization moves using unrealized losses.

- Use AI to anticipate liquidity and volatility risks.

- Integrate on-chain credentials for auditable ownership verification.

| Emerging Trend | Description | Investor Impact |

| Predictive automation | AI-driven forecasting and risk modeling | Enables preemptive rebalancing |

| Modular APIs | Plug-and-play analytics | Simplifies multi-platform setups |

| On-chain proof of reserves | Verifiable portfolio ownership | Eases audit processes |

| Smart tax triggers | Real-time gain/loss harvesting | Optimizes tax filings |

The next evolution will blur the line between tracking and advising – creating systems that not only gather data but also interpret it intelligently. Still, transparency will remain the ultimate difference between reliable automation and blind trust.

Conclusion

Looking across all platforms – from beginner dashboards to institutional-grade systems – one truth stands out: automation has become the unseen foundation of successful crypto investing. The real question is no longer “Should I automate?” but rather “What level of automation aligns with my goals and risk tolerance?”

Automation doesn’t mean losing control – it means designing systems that think faster, calculate more accurately, and remove the friction that disrupts consistency.

As investors move deeper into 2025, automation will increasingly define competitiveness. The divide between manual and automated portfolios will widen – not just in performance, but in decision quality, emotional discipline, and tax efficiency.

Those who embrace automation early gain more than convenience – they gain clarity. In the ever-evolving world of crypto, where complexity and speed multiply daily, the investors who learn to scale alongside intelligent systems will be the ones who stay ahead.