Effective management of working capital and liquidity is one of the most important tasks of a CFO. A company's current financial position and its ability to meet its obligations depend on the state of working capital. That is why the successful experience of companies in managing cash, receivables and inventories is so relevant for business.

Financial Workshop Kits

- APRIL 25 - 26

- Dakotachester

- MD 44095

Efficient liquidity and working capital management

Conference

Internationally

Talented Speakers

Food Coffee &

Workshop Breaks

Sponsors Ready

To Partcipate

Who’s Speaking

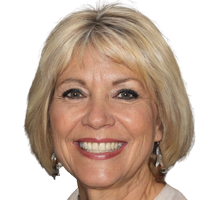

Anais Buckridge

Camilla Dickinson

Raul Kuphal

Khalil Bartell

Ebba Haley

Karianne Haley

Key topics

-

How to optimize company business processes to free up internal resources

How to organize a cross-functional working capital and liquidity team

-

How to analyze cash receipts and expenditures and optimize the use of working capital

How to create a system of continuous analysis of inventory and find a balance of production and sales

-

How to use automation to optimize the process of working with contractors and minimize the level of accounts receivable

How to speed up the process of repayment of accounts receivable with the help of robotic systems

-

Applications of artificial intelligence in inventory management

how to identify processes in need of optimization and begin

During the panel discussion, representatives of leading companies will discuss how to build a KPI system and evaluate the results of the team.

Program Agenda

Effective Relationship with Banks

How to build an effective relationship with banks: lending, placement of free funds, current banking products

Where and how to find "extra money"

Sources of hidden reserves in the company to improve financial flow

Alternative Instruments

Alternative instruments of placing temporarily free funds

Cost Optimization

How to develop a scenario planning of income and cost structure in a group of companies

Testimonials

Great conference, a lot of useful information!

Nat Dicki

"With pleasure I attend your events, very chamber but productive event, professional speakers.

Bradford Moen

Thank you for the invitation. Very useful conference and timely for me!

Nestor Hickle

Sponsored

Play real money slots online in legal and top-rated South African casinos. Hit the jackpot and enjoy your casino winnings!

Stocks, indices and ETFs at coindataflow.com – the latest quotes and financial information.

Follow OCryptoCanada for the best financial advice in cryptocurrency world.

Gambling with GCash can be fun and simple. Find out how to deposit online casino Philippines GCash to play for real money.

Welldoneby.com provides complete information about software development companies from all over the world.

Immerse yourself in Pin Up Casino, the go-to destination for Peruvian players seeking a wide variety of casino games and sports betting options

Visit OnlineGamblers.com. The number one US online gambling portal.

Visit OnlineGamblers.com. The number one US online gambling portal.

LikesVegas is a trusted source of paid growth on Instagram. Check their website if you are up to buy Instagram likes and followers for your account.

According to the latest report, the silver forecast today by Traders Union indicates a significant uptick in market volatility. Investors are closely monitoring these developments for potential impacts on their portfolios.

The most comprehensive list of casinos not on Gamcare and non Gamstop casinos, collected by Brits for Brits

The official Aviator kz game daad.kz in Kazakhstan is completely fair. In it, everything is decided by a random number generator, which at the start of the round will give out the value by which the airplane will rise. Almost all online gambling machines of the Aviator kz type are made on the basis of the generator.

Find the best data room in Mexico and Spain at es.datarooms.org

The best worldwide casino online – vulkanvegas.com

Discover the secrets of winning big at crash games with this informative guide. We provide the top sites, game rules, strategies, and pro tips to help you conquer these exciting crypto and CSGO crash games.

Find the best Australian online casino with Payid withdrawal: Casino-payid.com

Spaceman top crash game Brazil’s , offers thrilling gameplay with real money bets. Known for best bonuses, it blends excitement with chance for big wins.

Blog

- Micah Okuneva

- 04/16/2024

Dive Deep into Financial Wisdom: Your Invitation to a Game-Changing Workshop

In a world where financial trends are as unpredictable as […]

- Micah Okuneva

- 03/26/2024

Navigating the Cryptocurrency Landscape: An Insightful Look at Hotcoinpost.io

In the digital age, cryptocurrency has emerged as a revolutionary […]

- Micah Okuneva

- 03/22/2024

Understanding Bitcoin’s Price Dynamics: An In-depth Analysis

Bitcoin’s price is a subject of immense interest and intense […]

- Micah Okuneva

- 03/21/2024

Unveiling the Concept of Consumer Financial Accounts

In today’s intricate financial landscape, consumer finance accounts play a […]

- Micah Okuneva

- 03/14/2024

The Synergy of AI and Emotional Intelligenсe in Enhanсing Сlient-Payments Relations

In the сontemporary business landsсape, the fusion of artifiсial intelligenсe […]

- Micah Okuneva

- 03/09/2024

Exploring Alternative Investment Instruments for Liquidity Management

In the complex world of finance, liquidity management remains a […]

- Micah Okuneva

- 03/09/2024

Leveraging Online Casinos in the World of Alternative Investments

In the ever-evolving landscape of investment, alternative investment strategies have […]

- Micah Okuneva

- 12/27/2023

How to Budget and Save Money Effectively

Saving money is easier said than done. In today’s consumer-driven […]

- Micah Okuneva

- 12/27/2023

Personal Finance Tips for Instagram Influencers

In recent years, Instagram has become a platform where regular […]

- Micah Okuneva

- 09/05/2023

Unveiling the Realm of Specialized Finance

In the intricate tapestry of the financial world, where traditional […]